Indicators on Feie Calculator You Should Know

Wiki Article

The smart Trick of Feie Calculator That Nobody is Talking About

Table of ContentsMore About Feie CalculatorNot known Facts About Feie CalculatorThe Buzz on Feie CalculatorFeie Calculator - QuestionsThe Best Guide To Feie Calculator

He offered his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his other half to help meet the Bona Fide Residency Examination. Neil directs out that getting home abroad can be testing without initial experiencing the area."We'll absolutely be beyond that. Even if we come back to the US for physician's consultations or business calls, I doubt we'll spend greater than one month in the US in any kind of offered 12-month period." Neil stresses the value of stringent monitoring of united state sees (American Expats). "It's something that individuals require to be actually attentive concerning," he claims, and encourages deportees to be careful of common mistakes, such as overstaying in the united state

The 7-Minute Rule for Feie Calculator

tax responsibilities. "The reason that U.S. taxes on worldwide revenue is such a big deal is since many individuals forget they're still subject to united state tax obligation also after relocating." The united state is one of minority nations that taxes its citizens no matter where they live, meaning that even if an expat has no revenue from U.S.tax obligation return. "The Foreign Tax Credit report permits individuals operating in high-tax nations like the UK to counter their U.S. tax responsibility by the quantity they have actually already paid in taxes abroad," states Lewis. This ensures that expats are not taxed twice on the same earnings. Those in low- or no-tax countries, such as the UAE or Singapore, face added difficulties.

How Feie Calculator can Save You Time, Stress, and Money.

Below are some of the most frequently asked concerns about the FEIE and other exemptions The International Earned Revenue Exemption (FEIE) permits united state taxpayers to leave out approximately $130,000 of foreign-earned revenue from government income tax, reducing their united state tax obligation liability. To qualify for FEIE, you should fulfill either the Physical Existence Examination (330 days abroad) or the Authentic Home Test (prove your key home in a foreign country for an entire tax year).

The Physical Existence Test additionally needs U.S (Physical Presence Test for FEIE). taxpayers to have both an international income and an international tax obligation home.

A Biased View of Feie Calculator

A revenue tax treaty between the united state and an additional nation can aid stop dual tax. While the Foreign Earned Earnings Exclusion minimizes gross income, a treaty might provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Report) is a required declaring for united state citizens with over $10,000 in foreign monetary accounts.Eligibility for FEIE depends on conference details residency or physical visibility tests. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright tax, marijuana taxes and divorce related tax/financial preparation matters. He is a deportee based in Mexico.

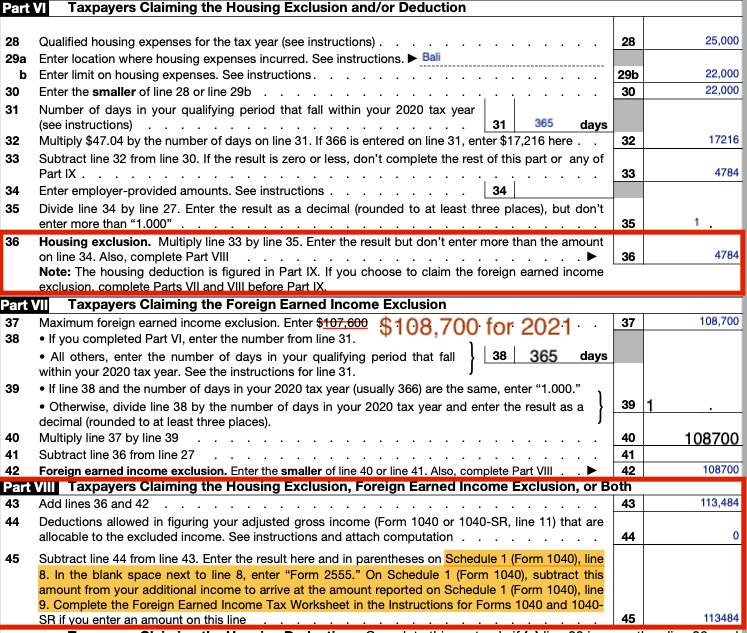

The international made earnings exclusions, in some cases referred to as the Sec. 911 exclusions, omit tax on salaries earned from functioning abroad.

Our Feie Calculator Ideas

The tax obligation advantage excludes the income from tax obligation at bottom tax prices. Formerly, the exemptions "came off the top" minimizing income topic to tax at the leading tax obligation rates.These exemptions do not exempt the earnings from US tax yet merely supply a tax decrease. Note that a bachelor functioning abroad for all of 2025 who gained concerning $145,000 without any other earnings will certainly Get the facts have gross income lowered to zero - successfully the very same answer as being "tax totally free." The exclusions are computed on a daily basis.

Report this wiki page